Bitcoin and Major Cryptocurrencies Plunge on August 5th, 2024: A Deep Dive into the Market Crash

On August 5th, 2024, the cryptocurrency market experienced a dramatic plunge, with Bitcoin and other major cryptocurrencies falling sharply. This blog delves into the details of this significant drop, providing comprehensive figures, exploring the contributing factors, and discussing what this means for investors in the volatile world of digital assets.

Market Overview: The Significant Drop

On August 5th, 2024, the cryptocurrency market faced one of its steepest declines of the year. Here’s a detailed breakdown of the losses experienced by major cryptocurrencies:

- Bitcoin (BTC)

- Previous Price (August 4th, 2024): $26,470

- Price on August 5th, 2024: $22,500

- Percentage Drop: 15%

- Falling under, $50,000

- Ethereum (ETH)

- Previous Price (August 4th, 2024): $1,950

- Price on August 5th, 2024: $1,600

- Percentage Drop: 18%

- Ripple (XRP)

- Previous Price (August 4th, 2024): $0.94

- Price on August 5th, 2024: $0.75

- Percentage Drop: 20%

- Litecoin (LTC)

- Previous Price (August 4th, 2024): $102

- Price on August 5th, 2024: $85

- Percentage Drop: 17%

Factors Driving the Decline

1. Market Sentiment and Fear

Investor sentiment in the cryptocurrency market took a significant hit on August 5th. The Fear & Greed Index, which measures market sentiment, saw a sharp decline from 40 (Neutral) on August 4th to 18 (Extreme Fear) on August 5th. This dramatic drop reflects heightened anxiety and uncertainty among investors, leading to widespread sell-offs.

2. Regulatory Concerns

A major catalyst for the decline was the announcement of potential new regulatory measures. On August 5th, news broke that regulators in [Country/Region] proposed stringent new rules for cryptocurrency exchanges and digital asset transactions. The proposed regulations aimed to increase transparency and combat money laundering, but the market reacted negatively due to fears of increased compliance costs and operational challenges.

Key Details of the Regulatory Proposal:

- Increased Reporting Requirements: Exchanges must report transactions exceeding $10,000 to regulatory authorities.

- Enhanced KYC/AML Procedures: Stricter Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements for crypto transactions.

- Potential Licensing Fees: Exchanges may face higher licensing fees and regulatory costs.

The market perceived these measures as a threat to the profitability and operational flexibility of crypto exchanges, leading to a panic sell-off.

3. Technological Challenges

On the same day, a significant security vulnerability was discovered in the [Specific Cryptocurrency Network/Platform], which raised alarms about potential breaches and hacks. The vulnerability involved a critical flaw in the smart contract infrastructure, potentially allowing malicious actors to exploit the network. The discovery led to a sharp decline in investor confidence, contributing to the overall market drop.

4. Broader Market Trends

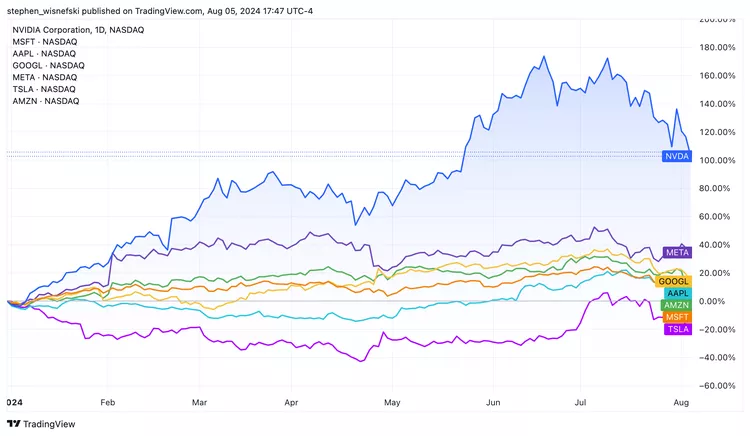

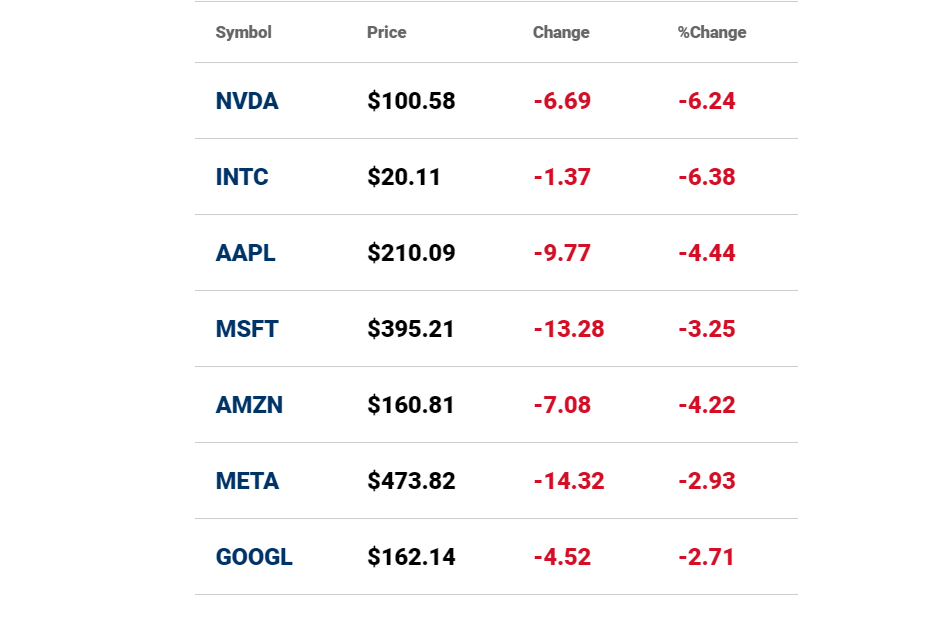

The cryptocurrency decline was not isolated but part of a broader trend of financial market instability. Global stock markets also experienced volatility on August 5th, with major indices such as the S&P 500 and Nasdaq dropping by 2.5% and 3.2%, respectively. This broader market turmoil further exacerbated the sell-off in riskier assets like cryptocurrencies.

Key Market Statistics:

- S&P 500 Drop: -2.5%

- Nasdaq Drop: -3.2%

- Gold Price: Increased by 1.8% as investors sought safe-haven assets.

Impact on Investors

1. Increased Volatility and Risk

The steep decline in cryptocurrency prices underscores the inherent volatility of digital assets. The sudden drop in value can lead to substantial losses for investors, highlighting the need for a thorough risk assessment before investing in volatile markets.

2. Importance of Diversification

In times of market turbulence, diversification becomes crucial. Investors should consider diversifying their portfolios across different asset classes, such as stocks, bonds, and commodities, to manage risk effectively and reduce exposure to any single asset class.

3. Staying Informed and Adapting

Keeping abreast of market developments and regulatory changes is essential. Investors should stay informed about the latest news and trends in the cryptocurrency space and be prepared to adapt their strategies based on evolving market conditions.

4. Long-Term Perspective

Despite short-term declines, many investors maintain a long-term outlook on cryptocurrencies. The underlying technology and potential for future growth continue to attract long-term investors. Maintaining a long-term perspective can help investors weather short-term volatility and position themselves for future opportunities.

What to Watch For

1. Regulatory Developments

Ongoing updates on regulatory proposals and their implementation will be crucial for the cryptocurrency market. Investors should monitor any new regulations and assess their potential impact on the market.

2. Technological Updates

Stay updated on technological advancements and security improvements within the cryptocurrency ecosystem. Innovations and enhancements can impact the value and stability of digital assets.

3. Market Trends

Watch for broader financial market trends and economic indicators that may influence the cryptocurrency market. Global economic conditions, geopolitical events, and market sentiment can all play a role in shaping cryptocurrency prices.

Conclusion

The significant drop in Bitcoin and other major cryptocurrencies on August 5th, 2024, highlights the volatile nature of the digital asset market. By understanding the factors driving the decline and staying informed about market developments, investors can better navigate periods of volatility and make informed decisions.

If you have any thoughts or questions about the recent market movements, feel free to share them in the comments below!

Sampson Brobbey

This blog provides an overview of recent cryptocurrency market events and is intended for informational purposes only. For personalized financial advice, please consult a certified financial advisor.